(Primary Keyword: Fuaark case study | Secondary: Fuaark business strategy | Support: Fuaark digital marketing strategy / success story)

Story-Driven Introduction (From a Founder’s Desk)

There was a night when I stopped looking at growth charts and just stared at a supplier sheet.

It was past 2 a.m. Demand was coming in faster than we could plan for. Customers wanted consistency. Creators wanted drops. Inventory logic was breaking. And the old playbook—limited releases, gut-based forecasting, influencer-heavy pushes—was starting to feel fragile.

The problem wasn’t selling gym clothes.

The real problem was building something that could grow without breaking trust.

That moment forced a reset.

And that’s where this Fuaark case study really starts.

1. ORIGIN

The brand didn’t begin with trends or mood boards. It started with a very practical observation: people who train seriously in India were compromising. Either the gear looked good but failed in workouts, or it performed well but felt disconnected from local gym culture.

This wasn’t a fashion gap.

It was a functional gap.

So the early idea was simple—build training-first apparel for people who actually lift, sweat, and show up daily. No overbranding. No unnecessary styling. Just gear that earns respect on the gym floor.

2. EXISTENCE (Why the Brand Matters)

Fitness in India stopped being aspirational and became habitual.

Gyms turned into daily environments. Creators became educators. And apparel quietly turned into a signal—of discipline, seriousness, and belonging.

The brand matters because it sits exactly where this shift happened. It serves people who don’t want “athleisure” but also don’t relate to global brands that miss local realities.

That middle space—serious training, accessible pricing, real community—is why the brand exists.

3. POSITION (Market Position)

The positioning is very clear and very intentional.

Not celebrity-driven.

Not lifestyle-heavy.

The brand competes on:

- How the fabric performs under load

- How fast feedback reaches production

- How credible it feels among real gym users

It lives between mass athleisure and premium performance brands, owning the “everyday serious lifter” segment.

4. USP (Unique Selling Proposition)

Built by people who train.

Improved by people who train.

Scaled through systems, not noise.

The real USP isn’t a product feature. It’s the feedback loop—community input doesn’t sit in comments, it shapes the next batch.

5. HISTORY (Key Turning Points)

- Phase 1: Direct-to-consumer launch through social platforms

- Phase 2: Trust built through creators who actually trained, not celebrities

- Phase 3: Operations became disciplined—inventory, timelines, logistics

- Phase 4: The shift from “selling apparel” to building a fitness ecosystem

Every phase fixed a real constraint instead of chasing hype.

6. ACHIEVEMENTS

- Strong repeat behavior in under five years

- Clear category authority in gym-focused apparel

- Movement from unpredictable drops to demand-aware planning

These are not vanity wins. They’re signs of operational maturity.

7. STATISTICS (Explained Simply)

- Revenue grew roughly 3–4x year-on-year during peak D2C expansion

- Over 60% repeat customers, showing real brand stickiness

- Most traffic comes from organic and social, reducing paid dependency

📊 How this would be visualized:

- A line graph showing steady revenue climb

- A cohort bar chart highlighting repeat buyers

- A pie chart breaking down traffic sources

Together, these numbers show trust compounding—not one-time spikes.

8. POWER OF NETWORK

The biggest advantage isn’t factories or ads.

It’s people.

Creators, trainers, gym owners, and customers act as distributed brand nodes. When they wear it, it validates the product far better than paid media ever could.

That network keeps acquisition costs sane and credibility high.

9. DIVERSIFICATION

Growth followed usage, not trends:

- Bottom wear expanded into tops, then outer layers

- Core male audience slowly widened into lifestyle use

- Apparel became a gateway into fitness culture

Nothing was rushed. Each layer earned its place.

10. EXPANSION

The focus was depth before distance.

Before chasing new regions, the brand improved:

- Product consistency

- Supply reliability

- Average order value

Only after that did wider penetration make sense.

11. COLLABORATIONS

Collaborations weren’t about reach. They were about relevance.

- Fitness creators

- Powerlifting communities

- Niche athletes

Each partnership added credibility, not noise.

12. INTEGRATIONS

Behind the scenes, scale came from systems:

- E-commerce infrastructure

- Logistics partners

- CRM and retention tools

These integrations allowed growth without chaos.

13. ACQUISITIONS

Instead of buying brands, the focus stayed on capabilities—better sourcing, smarter tech, stronger teams.

It kept the culture intact.

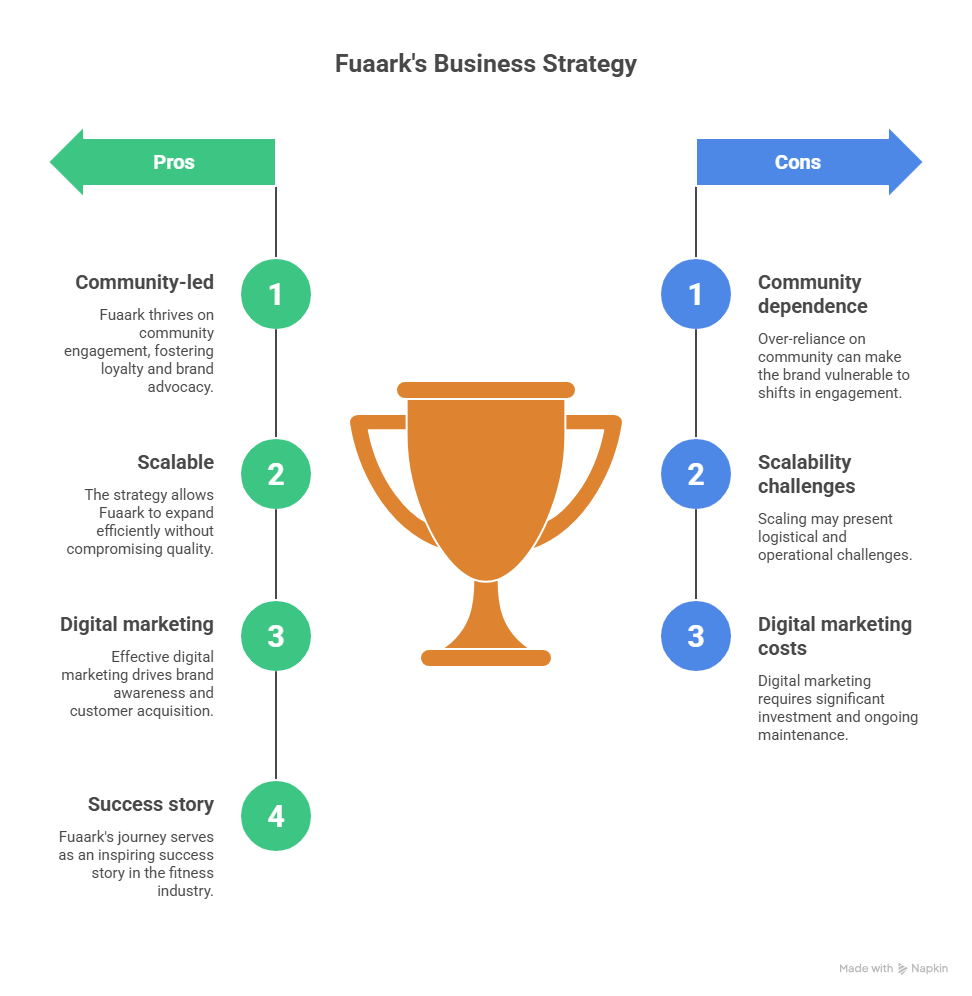

14. STRATEGIES FOLLOWED

- Community-first brand building

- Demand-driven inventory planning

- Creators as distribution, not billboards

- Trust built over discounts

This is the real Fuaark business strategy.

15. PROBLEMS FACED

- Scaling without quality slipping

- Influencer fatigue in the market

- Predicting demand in a volatile category

- Standing out in an overcrowded fitness space

These were structural problems, not cosmetic ones.

16. SOLUTIONS

- Closed feedback loops with customers

- Faster, smaller production runs

- Education-driven content instead of pure ads

- Community validation over mass appeal

Each solution reduced risk, not just boosted reach.

17. PROCESS OF BECOMING BIG

- Solve a real gym problem

- Earn trust through creators

- Build operational discipline

- Increase repeat usage

- Expand the ecosystem, not just SKUs

Growth was designed step by step.

18. EXTENDED & DETAILED DIGITAL MARKETING STRATEGY

Brand Voice & Tone

Straight. Honest. Gym-floor real.

No exaggerated motivation. No fluff.

Platform Strategy

- Instagram: Real workouts, product in motion, UGC

- YouTube: Long-form fitness education

- Website: Clear storytelling + conversion clarity

- Email & WhatsApp: Drop alerts, loyalty nudges, restocks

Content Formats

- Training clips

- Fabric explanations

- Transformation journeys

- Community reposts

Influencer & Community Strategy

Micro-creators over celebrities.

Depth over reach.

Campaign Psychology

Belonging beats aspiration.

Consistency beats virality.

This is the real engine behind the Fuaark digital marketing strategy / success story.

19. STRONG HUMAN CONCLUSION

This Fuaark case study isn’t really about apparel.

It’s about listening before scaling.

About respecting customers instead of chasing algorithms.

About building systems that protect authenticity as growth accelerates.

In a market obsessed with speed, this brand chose discipline.

And that choice is what turns a fitness label into a long-term business.

That’s not promotion.

That’s strategy.